Owning a home is a journey beyond the initial purchase; unexpected expenses can pop up like daisies in the spring. Investing in energy efficiency can reduce those costs, but not without their own price tag up front. So what’s a homeowner to do?

This dilemma has not gone unnoticed, and with energy demands always on the rise, the US government decided enough was enough. August 2022 saw the introduction of the Inflation Reduction Act, an effort to address climate change, which incentivizes energy efficiency. Homeowners can now decrease their taxes and receive two tax credits for making energy efficient changes. This bill rewards numerous fixes and upgrades, like installing new HVAC systems, windows, doors, and more. Those looking to make smaller changes can also receive rebates for switching old appliances for energy-efficient ones.

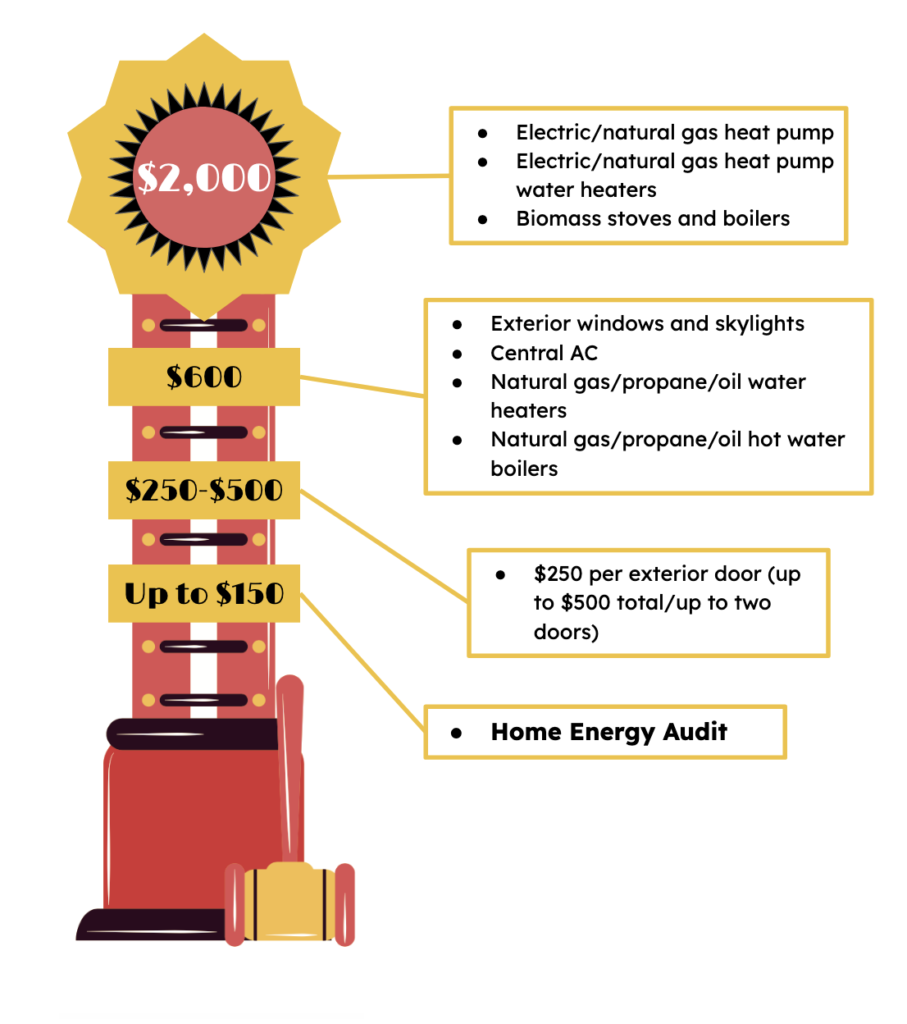

The bill takes some inspiration from the Nonbusiness Energy Property Credit with its own additions, starting with the new title of Energy Efficient Home Improvement Credit. This credit covers 30% of costs made throughout the year and covers certain types of insulation, air sealing materials, heat pumps, furnaces, air conditioning systems, boilers, stoves, and home energy audits. It also includes an annual limit of $1,200 so you can continue to make improvements year after year.

The best way to take advantage of this tax credit is to understand what your home needs and start with a home energy audit. Home energy audits collect all of the data about your home, from where you’re losing energy to how well your energy is being used.

At Energy Efficiency Experts, our home energy auditors inspect the structural integrity of your home and look for possible cracks and holes in what we call the “conditioned envelope”, or the shell of your home which contains all your conditioned air. We inspect your home’s foundation, cantilevers, crawlspaces, and attic, as well as test all gas appliances. Our focus is increasing attic insulation, but we can also airseal, install new fans, update old HVAC systems, and more. By the end of our two hour home energy audit, we provide a personalized report with our recommendations on moving forward. We also do all the rebate paperwork for applicable homes.

Energy efficiency has never been more accessible or affordable, and 2023 can be your year. Ditch the high bills and settle into some sweet, sweet savings. If you live in the Washington DC/Maryland/Virginia (DMV) area and are interested in learning more about your home, schedule a home energy audit at https://energyefficiencyexperts.com/contact/ or call our office at 202-557-9200.

Curious about what other services we provide? Check out the full list of auditing services and see what our in-house crew can do for you!